Mastering the Pocket Option Live Strategy

In the dynamic world of online trading, pocket option live strategy pocket option live strategy has emerged as a significant approach for traders aiming to maximize their profits. This article delves into the various aspects of this strategy, highlighting essential techniques, tips, and potential pitfalls that traders should be aware of. By understanding the underlying principles of the Pocket Option live strategy, traders can enhance their decision-making process and achieve better outcomes.

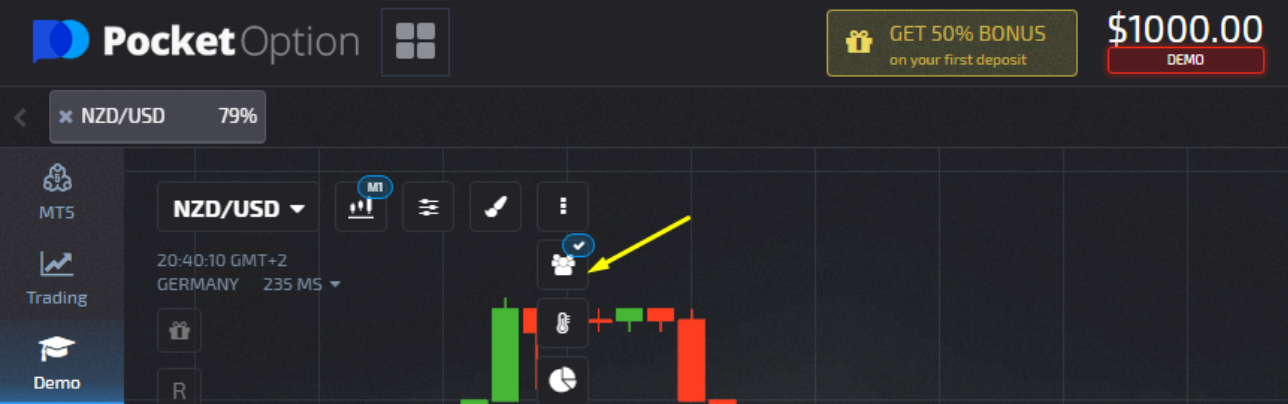

Understanding Pocket Option

Pocket Option is an online trading platform that allows users to trade various financial instruments, including forex, cryptocurrencies, and commodities. The platform is well-known for its user-friendly interface, diverse trading options, and real-time trading capabilities. Traders are drawn to the platform not just for its ease of use but also for its potential to generate significant returns, particularly when employing effective live strategies.

What is a Live Strategy?

A live strategy in trading refers to the real-time approach traders use to make decisions based on current market conditions. Unlike static strategies that may rely on historical data and backtesting, live strategies require continuous analysis of market trends, news, and price movements. This requires traders to be vigilant and responsive to changes, allowing them to make informed decisions that can lead to successful trades.

Core Components of the Pocket Option Live Strategy

Developing an effective live strategy on Pocket Option involves several key components:

1. Market Analysis

Successful trading hinges on robust market analysis. Traders should employ both technical and fundamental analysis to understand market sentiments. Technical analysis involves studying price charts, indicators, and patterns, while fundamental analysis considers economic events, news releases, and market psychology.

2. Risk Management

Implementing a solid risk management strategy is crucial. This means setting limits on how much you invest in a single trade and maintaining a balanced overall portfolio. Many traders use techniques like the Martingale strategy, aiming to recover losses by increasing bet sizes. However, it’s essential to exercise caution to avoid significant financial pitfalls.

3. Time Frame Selection

The choice of time frame plays a significant role in live trading. Pocket Option offers various time frames ranging from minutes to hours, allowing traders to adjust their strategies based on market conditions. Scalping, day trading, and swing trading are popular among traders, depending on their objectives and trading styles.

Technical Indicators for Live Strategies

Using technical indicators effectively can enhance your trading strategy significantly. Here are some commonly employed indicators:

1. Moving Averages

Moving averages help traders identify trends by smoothing out price data. The simple moving average (SMA) and exponential moving average (EMA) can indicate bullish or bearish market trends.

2. RSI (Relative Strength Index)

The RSI is a momentum oscillator that measures the speed and change of price movements, helping traders identify overbought or oversold conditions in the market.

3. Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands. They provide insights into market volatility and can signal potential trading opportunities.

Psychological Aspects of Trading

Understanding the psychological factors influencing trading decisions is crucial. Emotional trading can lead to significant losses, as decisions driven by fear or greed often result in impulsive actions. Developing a disciplined approach and adhering to your trading plan can help navigate these psychological challenges.

Practical Tips for Successful Live Trading

Here are some practical tips to enhance your success with Pocket Option’s live strategy:

1. Start with a Demo Account

Before risking real money, practice your strategies on a demo account. This helps you understand platform features and refine your trading skills without financial pressure.

2. Keep a Trading Journal

Documenting your trades, including the rationale behind each decision and the outcomes, can provide valuable insights for future trades. Analyzing past performance helps identify what works and what doesn’t.

3. Stay Informed

Follow relevant financial news and trends that may impact the markets. Staying informed enables you to adapt your trading strategies to the fast-paced changes in the market.

Conclusion

In conclusion, mastering the Pocket Option live strategy requires a combination of market analysis, risk management, and psychological discipline. By employing effective techniques and remaining adaptable to market changes, traders can enhance their chances of success. Remember that consistent practice, education, and patience are vital in achieving long-term trading success on the Pocket Option platform. With the right approach, you can turn your trading endeavors into a profitable venture.